What 2023-2025 Data Says about Liquidity, Scarcity and Long-term Gains

The cult of Rolex and Patek Philippe has long surpassed the Royal wrists and the Movie stars, but recent years have changed the rivalry between them to the popular portfolio conundrum. Steel sports models and grand complications are now viewed by global collectors as another form of tech stock or fine art: price curves are analysed, macro-cycles, even carbon footprints, scanned. With this environment, a choice between the two marques may no longer be taste-related, it has come to such an extent to discuss diversification, currency hedging as well as cross-border resale avenues.

Collectors open to budget-friendly homage pieces can visit koniguhren.de for an accessible range that echoes many of the iconic styles discussed here.

The Luxury-Watch Investment Ecosystem of Today

The demand of luxury-watch endured a disruptive macro cycle in 2023-2024. Although Swiss exports declined by 3 % in 2024, the 2024 industry analysis conducted by Deloitte indicates that the pre-owned segment continues to grow faster than the main market and should rival it in terms of market size in 10 years time. A fifth of purchasers now uses the term investment as a chief acquisition drive strategy and brand-guaranteed Certified Pre-Owned (CPO) schemes have progressed toward full transparency in the sense of equity markets. To investors, those imply audited service records, blockchain provenance, and faster international transfers all of which squeeze risk premia and increase overall liquidity.

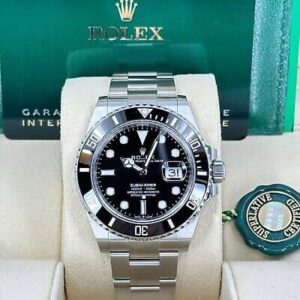

Rolex: Standard of Speed, Depth and Daily Subsistence

The one thing which most hard assets fail at is immediate (and even global) recognition and close to ATM liquidity, something that Rolex excels at. Wait lists at authorised dealers (which now utilise digital allocation systems) remain one of the scarcity drivers, with Rolex launching its own CPO programme last year to level prices by routing second-hand watches through segmented boutiques. The conservative design vernacular of the brand value-screen too; in a 2024 questionnaire of 700 collectors, 78 % were able to identify a Daytona at a ten-foot distance, as opposed to 41 % of nearest chronograph competitors.

- Healthy Secondary-Market Velocity: The WatchCharts Rolex Index from January 2022 to April 2025 demonstrated a compound growth rate (CAGR) of 5.7 % which exceeded the growth of gold and S&P 500 over the same period.

- Inflation Hedge in Action: Interestingly, when prices were briefly pushed up into inflation-effect territory in late 2023, the average price of Submariners on the market moved down only 0.8 % whilst tech shares lost 7 %.

- Daily Driver = Lifelong Desire: ISO-rated waterproofing and parachrom hairsprings make new Rolexes true daily drivers, expanding the potential consumer base to surfers, to CFOs, and all other sectors of the demographic continuum.

- Engineered Scarcity: Current annual production may be well over one million units and yet reference-level quotas mean that it remains impossible to buy halo models such as the so-called Pepsi GMT at retail, encouraging premium margins of 20 – 35 %.

Collectors of Prime Rolex References Still Follow

- Daytona 116500LN and vintage versions with the name of (Paul Newman) – auction favorites with top-line price tags.

- Submariner 126610LN vintage 5513 – classic liquidity with even tendency of crawling.

- GMT-Master II 126710 Pepsi and Batman – the colour-code infamy keeps the wait list in the double-digits.

- Day-Date 228238 (yellow gold) and 228236 (platinum) – the safe-haven you can call precious metal with in-built exclusivity.

Patek Philippe: Unicorns, Tonnes de Relation and the Multi-Generational Premium

Whether or not Rolex is the blue chip is up to you, but Patek Philippe is the venture fund; there are only a few slots to buy, the price of entry is high, and when rare references come to auction the upside is mega. The output is less than 70 000 items per annum and to purchase sports model of them, a person may need a long-term (several years) contact with an authorised salon. Scarcity makes every watch today a micro-cap asset: when a ref. 1563 steel Grand Complication was offered at USD 3.9 million at Sotheby’s in November 2024, it confirmed once again that Patek is the brand that can most effectively rewrite the norms of auctioning in one blow of the hammer.

- Technical Halo: Minute repeaters and split-seconds calendars send halo effect all over the catalogue to even plainer Calatrava models.

- Tailor-Made On-Ramp: Allocation groups determine buyer track record, decreasing apps idea-flipping and keeping long-run price plots steady.

- Heirloom Story: Patek still positions itself around its 1996 catchphrase to take care of it until the next generation; 64 % of buyers in a 2025 survey of collectors were intending to give their Patek to relatives, more than three times as many as those with Rolex.

- Auction-Based Price Findings: Rare lots adjust the level of the same references in private sales immediately, giving such owners unexpected upside.

Patek References of Maximal Potential

- Nautilus 5711/1A & 5990 – kept in limited production and hype that discontinuation was coming keeps floor prices elevated.

- Aquanaut 5167A & 5968A – fills the gap between the sporty and elegant that younger customers seek.

- Perpetual Calendar Chronograph 5970 and 5270 – complication pedigree elicits institutional bidders.

- Calatrava 5227 & 6119 – classic style that is gaining a developing audience among those who seek minimalist investment.

Table: Secondary-Market Dynamics 2022-2024

| Model | Brand | Avg. Annual Price Change 2022-2024 | Median Time to Sell (Days) |

|---|---|---|---|

| Rolex Daytona 116500LN | Rolex | +6.8 % | 14 |

| Rolex Submariner 126610LN | Rolex | +5.1 % | 17 |

| Rolex GMT-Master II Pepsi 126710 | Rolex | +5.9 % | 15 |

| Patek Nautilus 5711/1A | Patek Philippe | +4.2 % | 33 |

| Patek Aquanaut 5167A | Patek Philippe | +5.5 % | 29 |

| Patek 5970P | Patek Philippe | +7.2 % | 42 |

Strategic Match-Ups Time Horizons Risk Profiles and Portfolio Fit

The prospective Rolex collector looking to make a three-to-seven-year flip is inclined to make this combination of supply and demand policy as their exit strategy can increasingly be calculated in anticipation of cyclical slowdowns. The ten-year fixation forcing people on a longer time horizon (and with the temperament to stalk boutiques) to incline to Patek where low numerator scarcity augments long-run returns when inheritance-level examples come to auction.

Price-Appreciation Differentials

Pateks continue to make record hammer prices but with Rolex going broad-reference provides a more even equity curve. Not only did dispersion between the top and bottom quartile of Patek references remain at 17 points to Rolex’s 6 points in 2024, but this volatility around the average is an indicator of increased volatility in the price per reference on the secondary market – a larger dispersion implies greater optionality within the Geneva maison.

The Risk-Reward Scale and the Argument of Diversification

A barbell position, high liquidity, steel Rolex on one hand, low float, complicated Patek on the other, allows collectors to profit on both the efficiency of the transaction and the appreciation of tail-based events. An additional step to mitigate brand-specific drawdowns would be to periodically rebalance on the basis of index performance at every 24 months to maintain an exposure to breakout auction cycles.

Author Bio

People can describe him as Ethan M. Clarke, a horology analyst based in Zurich, a former portfolio strategist who would track the secondary watch marketplace over the past 10 years. His research combines behavioural finance and scholarship of luxury goods.